Pro Staking Plan

Posted : admin On 4/11/2022Once you have a profitable set of selections the next common question is how do I manage my betting bank to stake the selections.

In the article below David Morris creator of The Staking Machine Betting Staking software uses his knowledge and cool staking plan software to analyse the past profits of our own NH Portfolio selections.

------------------------------------------------------------------

Ask any professional gambler what sets them apart from the amateur and you will probably get the same answer each time.

Micko70 has shared a staking plan with followers of his blog and his Stake Back Plan is worth a test if you want to try a new staking system. Sensible Betting. The key to managing money is to bet sensibly. The main rule every punter should have is to only ever bet what they can afford to lose.

'The professional gambler doesn't bet for fun. They bet for profit'.

- This plan will add one unit after one loss. If you are betting 10 units, then the next bet (only after a losing bet) would be 20 units. After one win the stake will stay the same if the last stake is the same as the starting stake, or will decrease by the% if the last stake was bigger than the start stake.

- This staking plan comes from The Staking Machine software created by David Morris. It takes advantage of consistent betting systems by betting more when a system is doing worse than it has done historically and betting less when it is doing better than it has done historically.

- A decent staking plan cn make the difference between profit and loss. The Great Staking Challenge (Part 1) Many attest that there are some fundamental principles in gambling, just as there are for life as a whole.

Once you look at what that means in more detail - you realise that emotion has no part to play in successful betting. Emotion can effect what you bet on, how frequently you bet, and how much you bet. When emotion takes over on any of these factors you can wave goodbye to any long term profit.

The Staking Machine Software does not tell you what to bet on and how often to bet. It does however tell you how much to bet. The Staking Machine or TSM for short is designed to handle the money management side of betting. Money management is all about managing risk. Managing risk is all about research. And that is where TSM comes in.

The bench mark for all staking plans is level stakes. By this we mean a fixed unit per bet. A selection system that produces a profit to level stakes has a positive edge. You can't make money from betting without an edge. Before using TSM you must have a selection system that has an edge.

When using TSM and deciding which staking plan should be used there are many factors to consider. It is not all about which staking plan makes the most profit. To highlight some of these factors we shall use the

Punterprofits NH Portfolio Selection System which is based on over 20 years research including over 4500 bets. ( as of 23rd March 2009 ). At the bottom of the page is an attatchment called NH-Dated.TSM. This is the exact file all analysis has been carried out on. So lets look at the facts. Before looking at any staking plans, we must first look at all the available data in more detail. If you are following this in TSM, turn off commission. Punterprofits odds are based on SP prices.

The screenshot is taken from the TSM Quick Stats tab after all the previous bets have been loaded into TSM.

The reliability of the selection system shouldn't be in doubt. The 4754 bets go back to 1991. With 1855 winning bets that provides a strike rate of 39.02%. Average odds is 4.19 whilst the average winning odds is 3.00.

Moving on to ELS - Expected Losing Sequence. The maths behind the formula to calculate this is beyond the scope of this article. It is also beyond me to explain it. However, for those with Microsoft Excel you can use this formula.

=LN(n)/-LN((1-(sr/100)))

where n = number of bets and sr = strike rate as a percentage. So in our PunterProfits example.

17.11 = LN(4754)/-LN((1-(32.09/100)))

You can see further down the quick stats tab that the longest losing sequence was in fact 17 between 3434 and 3450. 1 or 2 above/below the ELS is fine. Anything more than that indicates that during your losing run, your strike rate was more/less than expected. Note that as the total number of bets analysed increases so does the ELS. For the ELS to be accurate you need a good sample of bet data.

The next thing to note is the Required Strike Rate. This is based on the average winning odds. For odds of 3.00 your strike rate must be at least 33.3% to break even. The selection systems strike rate of 39.02% passes this test.

As mentioned earlier, any selection system worth using must have an edge. The Punterprofits system has an edge of 17.08%.

Simplified Edge =( Average Winning Odds - 1 * Strike rate) - (1 - Strike rate)

For every £1 staked you would expect to make a profit of 17.08p.

The next thing to look at is S.D. - Standard Deviation of all the odds. The Punterprofits NH Selection System has a standard deviation of 4.74. The standard deviation is a measure of how spread out a set of numbers are. A high standard deviation indicates a wide spread range of odds where as a small deviation indicates a small range of odds used. The standard deviation can in one glance indicate the size of the range of odds in the selection system. For a normal distribution of data it is known that 68.27~% of members lie within 1 S.D. of the mean, 95.45~% within 2 S.D. and 99.73~% within 3 S.D. The PunterProfits S.D. is 4.74.

So far everything is looking good and we can say we almost certainly have a reliable selection system. We can expect a losing sequence of 17 at any point. Therefore any staking plan we use MUST be able to allow for 17 losses in a row.

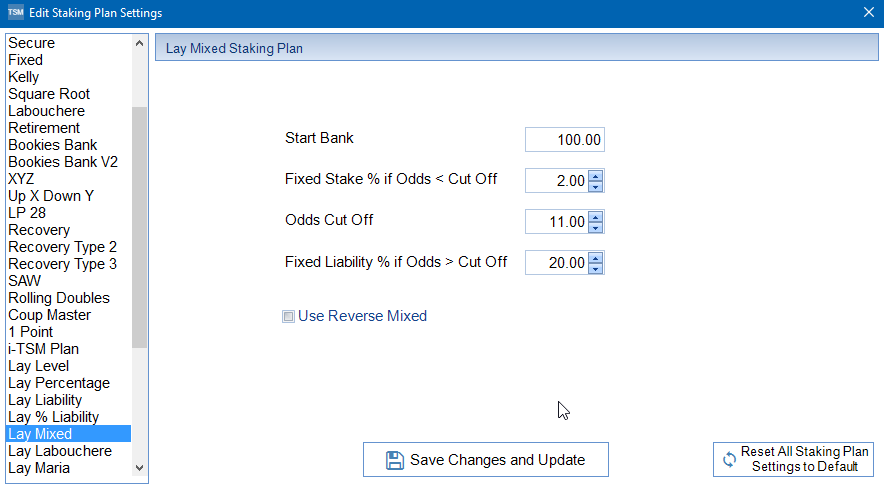

Going through the back staking plans we have on offer in TSM. Level, 1326, D’alembert, Fibonacci, Percentage, Parlay, Pro, Secure, Fixed, Kelly, Square Root, Labouchere, Retirement, Bookies Bank, XYZ, Up X Down Y and L.P.28. When comparing staking plans, there are always several problems. Clearly to increase profits over level stakes, increased stakes will have to happen. The question is how much of an increase is safe. How much risk do you want to have ?

1326, D'alembert and Fibonacci are all designed for use where odds equal 2 i.e. games of 50/50 chance. These staking plans should really be used where the average winning odds is close to evens. You can argue that the Fibonacci sequence can be used for a much greater odds range. And yes you may make a profit. However shuffling the sequence of results will sometimes highlight the Fibonacci staking plans flaws. By checking the frequency of winning odds we can see that 19 bets won at odds greater than 10. If you put these 19 bets at the bottom of the Fibonacci sequence instead of at the top you can see where the problems occur.

We now move on to Percentage betting. This is essentially level stakes however the stake is relative to the cumulative total. The beauty of percentage staking is that you should not ever become bankrupt providing you have your settings right. So what are the right settings. Well that depends on each selection system. The ELS is vitally important here. Assuming your starting out with a betting bank of £200 your stake needs to allow a losing run of 17 and more. Just because a losing run of 17 has occurred does not mean that it wont happen again after just one winner. I always like to have a betting bank that can cope with the ELS multiplied by 4. By that reasoning your initial stake needs to be -

Start Bank / 4 / ELS = 200/4/17 = £2.9

To work out your percentage to bet we do 100/200 * £2.9 = 1.45%. The Percentage Staking Plan Settings are therefore Start Bank = £200 and Percent to Bet = 1.45%. When betting, clearly there is a maximum stake. For arguments sake we will use £200 as the maximum bet we can ever bet. TSM allows you to set the maximum stake used. The Percentage Staking Plan with a max stake of £200 produces a profit of £103,559. So how long does it take to reach £200 stakes ? The first £200 stake can be found at bet number 2020. At this point the profit is already £13,988.

Pro Staking Planter

Moving on to the Parlay Staking Plan. The problem here is the maximum stake. If we are sticking to our maximum stake of £200 we can work out what parlay settings we can use. Average winning odds is 3. How long should it take before we reach £200 ? Starting with our initial stake of £2.90 and odds of 3 it only takes 5 bets before the maximum stake is reached. So with a parlay reset limit of 5, a Start bank of £200 and an initial Percent to Bet of 1.45% we have a profit of £9,214. Working backwards, a reset limit of 4 shows a profit of £9,276. A reset limit of 3 shows a profit of £4,969. And a reset limit of 2 shows a profit of £3,916. Now if we link the initial stake in the parlay run to the cumulative total. Our profits are allowed to grow. A reset limit of 5 shows a profit of £88,794. A reset limit of 4 shows a profit of £59,906. A reset limit of 3 shows a profit of £126,437. A reset limit of 2 shows a profit of £112,447. There comes a point in the parlay staking plan where the initial stake is greater than £200. At that point you are reverting to level stakes.

The problem with the parlay staking plan is that you really are dependent on the sequence of results. The higher the parlay reset the higher the chance of initially becoming bankrupt before actually winning your first parlay sequence. For that reason anything over 3 should be avoided. Ideally you should work out what your average winning sequence is and base it around that. For PunterProfits a reset of 2 or 3 should be used. A reset of 2 with maximum stakes of £200 shows a profit of £112,447. When you get to around bet 1960 the staking plan reverts to level stakes.

Moving onto the Pro staking plan. This is one of the most aggressive staking plans there are and is ideally suited to high strike rates. With an initial start bank of £200 and an initial percent to bet of 1.45%, the staking plan soon causes bankruptcy. Bet number 310 to be precise. Even if you dip into your wallet and top up your betting bank there are still long deep spikes in your cumulative total graph indicating large draw downs. With an ELS of 17 stay away from the Pro Staking Plan.

The secure staking plan is low risk and actually pretty hard to compare to level stakes. It can be best used with a bit of analysis. This involves looking at the frequency of winners per odds range. There is no complicated maths in this. Simply by looking at the winning odds frequency graph in TSM we can see that there were 810 winners in the range of 1.5 - 2.0. As to be expected, the frequency of winners decreases as the odds increase in size. If we split the data into 3 ranges we can increase profits. Range 1 = Less than 3. Range 2 = Greater than 3 but less than 4.5. And Range 3 = Greater than 4.5. When this is put into the secure staking plan settings, the profit is shown as £5651 as apposed to using default settings where the profit would be £4218.

Moving onto the fixed staking plan. This sets a fixed target per bet. This is great for larger odds but when betting on odds on favourites, the stakes can increase massively. In the punterprofits selection system there are 254 bets that are less than 1.5 in odds. If for instance the odds were 1.2 then to make a profit of £10, your stake would have to be £50. Food for thought.

The Kelly Staking Plan is always controversial. Some hate it. Some love it. The Kelly Staking Plan only allows you to place a stake on bets that offer value. We discussed edge earlier. The Kelly Staking Plan only places a bet where there is an edge. In TSM even if no stake is offered, a bet is still listed. The stake is shown as zero so that direct comparisons between staking plans can still be made.

Using Kelly Settings of 39% as our expected strike rate. A divisor of 4 and a start bank of £200 the profit shown is £9170. Interestingly it also shows a ROI - Return on Investment of 30.63% This is very high. The largest stake was only £19.3. There is of course the danger of bankruptcy early on if you get your expected 17 losses at the beginning of your sequence.

In the Square Root Staking Plan when the cumulative total is in profit, the profit is square rooted. This is added to your initial stake. With an initial stake of £2 and a start bank of £200 and maximum stakes of £200 the profit is £114,234. However, we know that the ELS is 17. We can therefore use an initial stake of £2.9. This gets us to maximum stakes of £200 at bet number 2187 and a slight increase in profit over using a £2 initial stake.

Best Lay Staking Plan

The Labouchere Staking Plan is pretty well known and I'm assuming I don't need to explain it. The general accepted sequence of numbers used is 1,2,3,4,5,6. This shows a profit of £9,369. Reverse labouchere shows a profit of £7,853. The beauty of the labouchere staking plan is you know what your highest stake will be. (£20) as there is a cut off.

The next staking plan is the Retirement Staking Plan. This is designed to make use of your Average Winning Odds. The Retirement Staking Plan stakes are kept in check by using a divisor of twice your Average Winning Odds. This is based fractionally so our average winning odds of 3 becomes 4/1. The initial divisor is therefore 8. After 8 losing bets the divisor increases by 1. The stakes increase but they remain relatively stable. The shortfall in the retirement staking plan is when we get 2 or 3 long losing runs right next each other. The stakes can continue to increase and our bank can take big hits. For that reason I always use the staking plan with maximum stakes turned on. With Recovery Staking Plans we also decrease our initial stake. Remember we use Start Bank / 4 / ELS = Initial Stake. For recovery staking plans I like to use Bank / 6 / ELS = £1.96. For minimum stakes we will round this up to £2. Our Percent To Bet is therefore 1%.

Using a start bank of £200, Initial Percent to Bet of 1% and Average Winning Odds of 4, the profit shown is £66,974. Maximum stakes of £200 are reached consistently at around bet 3284. Bookies Bank is next on our list. I have always liked this staking plan. It is a gentle loss recovery staking plan. As with the Retirement Staking Plan our initial stake is adjusted. With a start bank of £200 and an initial percent to bet of 1% the profit is shown as £1776.04. The largest stake is only £3.25. When the initial stake is linked to the cumulative total to allow growth the profit is shown as £93,642. With the maximum stake enabled, level stakes of £200 is reached at around bet number 2203.

The next staking plan is the XYZ staking plan. This is the do it yourself staking plan. I wont be discussing this one as its designed for people to add their own sequence based staking plans.

The Up X Down Y staking plan is similar in essence to the Fibonacci staking plan but can be adapted to work with larger odds. The only word of warning is that the sequence can be infinite. That's fine as long as you consider that in your settings. For every loss we will go up 1. Average Winning Odds is 3. We will therefore go back down 3 places in the sequence after a win. If you turn maximum stakes off you will see the danger with this setup. At one point our stake is around £166,000. Impossible. As with other staking plans, by using maximum stakes we can keep things under control. Maximum Stakes enabled gives us a profit of £95,030. The first £200 stake occurs at bet number 2027.

Pro Staking Plants

The last staking plan is L.P.28. This is designed for longer odds selection systems. The sequence allows for a losing sequence of 28. Our ELS of 17 should be no problem. The full sequence is 1111111111222222333344455667. With a start bank of £200 and 1 point equalling 1.45% of £200 - a profit of £2707 is made. When the initial stake is linked to the cumulative total the profit increases to £111,299. Maximum stakes are reached at bet number 1975 at which point it becomes level stakes.

Wow. That's some heavy reading so far. So what staking plan should we be using ?

Well............

Realistically in 20 years of betting you are going to probably want to take some money out from the betting profits. So realistically, perhaps we should be looking at which staking plan we should be using if betting on a year to year basis.

So... Lets quickly look atPunterProfits in the last 5 years.

The most successful staking plans over 20 years were, Percentage, Parlay, Kelly, Square Root, Retirement, Bookies, and L.P.28

Assume initial stakes where appropriate are 1.45% of £200 for Percentage, Parlay, Kelly, Square Root and L.P.28. Assume Initial Stakes are 1% of £200 for Retirement and Bookies. Assume the initial stakes are linked to the cumulative total to allow growth. Also assume maximum stake is £200. Level stakes are shown as £1 unit. Finally Parlay reset limit is 3 and the Kelly Divisor is 4.

** NB the figures above for the individual assume a £200 start bank at the start of each year ( ie the bank is reset to £200 each Jan 1st )

The 2005-2009 total figures assume a £200 start bank in 2005 with profits rolled forward and compounded. eg if you had started with £1000 on Jan 1st 2005, used the retirement staking plan your final bank total would be £1000 + £1036.26 * (£1000 / £200 ) = £6183 ie a profit of £5183

So on a year to year basis there are only 3 staking plans that make a profit each year. Kelly, Bookies and Retirement. The largest profits being the Kelly Staking Plan. As discussed previously, the danger with the Kelly Staking Plan is the large stakes that can be required and the danger of an immediate bankruptcy. You would of actually been bankrupt in 2008 and 2005 if you used the Kelly staking Plan. You can of course increase the divisor to decrease your stakes. The Kelly Staking Plan in my opinion is too high risk unless this is done so. Others will always argue otherwise. On a year to year basis my preferred staking plan is the Retirement Staking Plan or Bookies. On a year to year basis the Retirement Staking Plan produces slightly higher profits and a slightly higher ROI over Bookies.

Assuming you do not want to take any profit out and you wish to keep going and increase your stakes and hence your profits (see 2005-2009 row) there really isn't too much difference between all of the other staking plans (with the exception of the parlay staking plan). But for me it is again between the Retirement Staking Plan and the Bookies Staking Plan.

Looking at the graph above you can see the large dip in the Bookies Staking Plan at around bet number 1050. Our initial settings mean we can cope with this easily. However it can still be unnerving when this occurs. There are other stats to look at such as Largest Losing Sequence Peak to Trough in % but to be fair you can see it simply by studying the graph above. The retirement staking plan gets the nod over Bookies on this occasion.

Conclusion

To finish off our analysis we can now compare the Retirement Staking Plan with Level Stakes. Using the 2005 - 2009 data.

Using the right staking plan can increase profits safely. Here we have shown how to increase Level Stakes Profits by over 20%. We have done it by managing our risk and using the correct settings for our staking plan. Going forward one can never say for certain that the Retirement Staking Plan will produce the same results. However, we have looked at the all the available data. We have analysed it best we can. We have managed our risk to keep any chance of bankruptcy low. We can make an educated guess that results going forward will be similar to what has happened historically.

The important thing to remember and ask yourself with any staking plan is this - Can my staking plan handle the ELS - Expected Losing Run (which is 17 in this data) ? And then another losing run of 17 ? Just make sure that at no point do you let your emotions choose your stake. By doing your research and managing your risk at an early stage you can cut out emotion and make long term profits.

Data files in TSM format are available at the links below.

If you use the staking machine software you can import all the raw selection data used to produce the report above

NH-Dated-TSM is all data upto 23rd March 2009.

NH-Last5Years.TSM is the last 5 years of data only.